Understanding the intricate relationship between total supply and market capitalization is crucial for accurately predicting the price of any cryptocurrency, including Terra Classic (LUNC). In this article, we will delve into the mathematical underpinnings of these two key metrics and explore how they can be used to predict LUNC's price.

By examining the interplay of total supply and market cap, we can gain valuable insights into LUNC's potential price movements. Whether you're a seasoned investor or just starting your journey in the cryptocurrency world, this analysis will provide you with a solid foundation for making informed decisions about LUNC.

Total supply, circulating supply and market capitalization are three fundamental metrics that influence the price of a cryptocurrency like LUNC.

Total supply refers to the maximum number of LUNC tokens that will ever exist. It's a fixed quantity that cannot be increased or decreased.

The circulating supply of Terra Classic (LUNC) refers to the total number of LUNC tokens that are actively in circulation and available for trading on the market. This figure is distinct from the total supply, which represents the maximum number of LUNC tokens that will ever exist.

Market capitalization, on the other hand, represents the total value of all LUNC tokens in circulation. It's calculated by multiplying the current price of LUNC by its total supply.

The relationship between total supply and market cap is crucial in determining LUNC's price. A higher market cap indicates that investors value LUNC more, while a lower market cap suggests that investors are less willing to pay a premium for it. Additionally, changes in total supply can also impact the price, as a decrease in supply can lead to increased scarcity and potentially higher prices.

Now that we understand the building blocks of total supply and market cap, let's see how they work together to determine LUNC's current price. It's actually quite straightforward!

Imagine a giant bag filled with all the LUNC tokens in existence. This bag represents the total supply. The value of all these tokens combined, expressed in dollars, euros, or any other currency, is the market cap. The price of a single LUNC token is essentially its share of the total value in the bag.

We can express this relationship mathematically using the following formula:

Let's put this formula into action! You can find the latest market cap data for LUNC on various cryptocurrency websites.

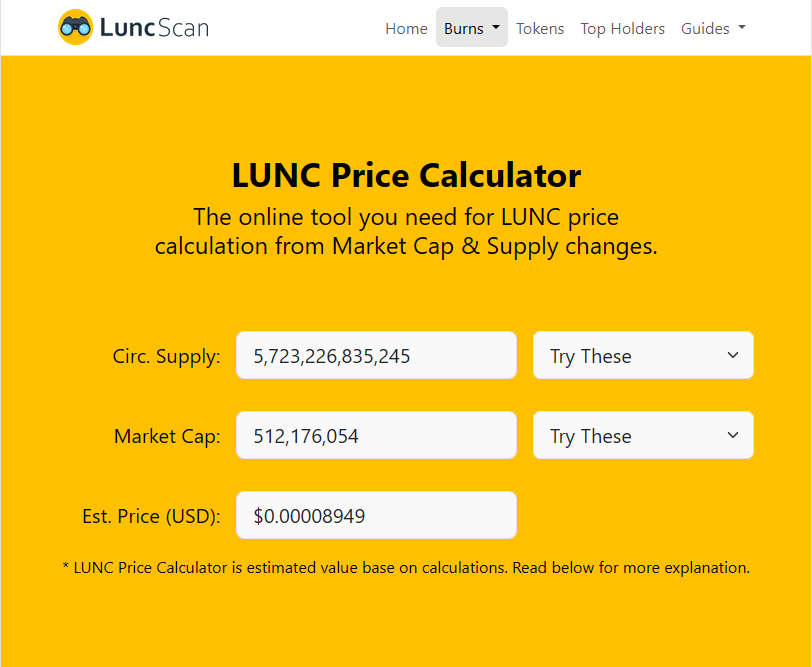

Additionally, helpful tools like LuncScan.com offer online LUNC price simulator. These simulators allow you to plug in different market cap values and see how it affects the theoretical price per LUNC token. By playing around with these tools, you can gain a deeper understanding of how changes in market cap can influence LUNC's price.

Remember, the market cap and price data you find online are constantly changing based on real-time trading activity. This formula provides a snapshot of the relationship at a specific point in time.

| Market Cap | Circulating Supply | LUNC Price |

|---|---|---|

| 500,000,000 | 5,800,000,000,000 | $0.00008621 |

| 1,000,000,000 | 5,000,000,000,000 | $0.00020000 |

| 5,000,000,000 | 4,500,000,000,000 | $0.00111111 |

| 10,000,000,000 | 4,000,000,000,000 | $0.00250000 |

| 15,000,000,000 | 3,500,000,000,000 | $0.00428571 |

| 20,000,000,000 | 3,000,000,000,000 | $0.00666667 |

| 25,000,000,000 | 2,500,000,000,000 | $0.01000000 |

| 30,000,000,000 | 2,000,000,000,000 | $0.01500000 |

| 35,000,000,000 | 1,500,000,000,000 | $0.02333333 |

| 40,000,000,000 | 1,000,000,000,000 | $0.04000000 |

| 45,000,000,000 | 500,000,000,000 | $0.09000000 |

| 50,000,000,000 | 400,000,000,000 | $0.12500000 |

| 55,000,000,000 | 300,000,000,000 | $0.18333333 |

| 60,000,000,000 | 200,000,000,000 | $0.30000000 |

| 65,000,000,000 | 100,000,000,000 | $0.65000000 |

| 70,000,000,000 | 50,000,000,000 | $1.40000000 |

| 75,000,000,000 | 40,000,000,000 | $1.87500000 |

| 80,000,000,000 | 30,000,000,000 | $2.66666667 |

While total supply represents the maximum number of LUNC tokens that will ever exist, circulating supply refers to the actual number of LUNC tokens that are actively circulating in the market. This distinction is crucial because changes in circulating supply can have a direct impact on LUNC's price.

One of the primary factors affecting circulating supply is staking. When LUNC holders stake their tokens, they are essentially locking them up to support the network's security and earn rewards. Staked LUNC tokens are not actively circulating in the market.

Therefore, an increase in the number of LUNC tokens being staked can lead to a decrease in circulating supply. This can potentially create a scarcity effect, driving up the price of LUNC. However, it's important to note that the impact of staking on price depends on various factors, including the overall market sentiment and the level of demand for LUNC.

In addition to staking, other factors can influence the circulating supply of LUNC, including:

It's important to note that the relationship between total supply and price is not always straightforward. Other factors, such as market sentiment, economic conditions, and technological developments, can also play a significant role in influencing LUNC's price.

Market capitalization, as we've seen, is a crucial determinant of LUNC's price. It reflects the overall value that investors place on the cryptocurrency. Let's explore some of the key factors that can influence market cap:

Investor sentiment plays a significant role in shaping market cap. Positive sentiment, driven by factors like news, partnerships, or technological advancements, can lead to increased demand for LUNC, driving up its price and market cap. Conversely, negative sentiment, fueled by concerns or unfavorable events, can cause investors to sell off their LUNC holdings, reducing market cap and price.

The adoption of LUNC and its underlying technology can also impact market cap. As more people and businesses use LUNC for transactions, payments, or other applications, demand for the token increases, driving up its price and market cap. Conversely, a decline in adoption can lead to a decrease in market cap.

The utility of LUNC within the Terra Classic ecosystem is another factor that can influence market cap. If LUNC is widely used for various purposes, such as governance, payments, or DeFi applications, it becomes more valuable to investors, leading to a higher market cap. On the other hand, if LUNC's utility is limited, it may struggle to attract investors and maintain a high market cap.

External factors, such as macroeconomic conditions, regulatory changes, and competition from other cryptocurrencies, can also impact LUNC's market cap. For example, a bullish cryptocurrency market overall can benefit LUNC, while a bearish market can have a negative impact.

By understanding these factors, you can better anticipate how changes in market cap might affect LUNC's price and make more informed investment decisions.

The Power of Total Supply and Market Cap in Predicting LUNC's Price.

In this article, we have explored the intricate relationship between total supply and market cap in determining the price of Terra Classic (LUNC). By understanding these two fundamental metrics, we can gain valuable insights into LUNC's potential price movements.

Predicting cryptocurrency prices is inherently challenging and involves a degree of uncertainty. While total supply and market cap provide valuable insights, it's essential to continuously monitor and analyze other factors that could influence LUNC's price. Staying updated on market trends, technological developments, and community sentiment is crucial for making informed investment decisions.

The content provided on this platform is intended for informational and educational purposes only, and should not be construed as financial advice, recommendation, or solicitation to buy, sell, or hold any cryptocurrency or investment. Investing in cryptocurrencies and other digital assets carries significant risks, including the risk of loss of principal. It is essential to conduct thorough research and due diligence before making any investment decisions.

Always consult with a qualified financial advisor to assess your financial situation and risk tolerance before making investment choices. The author and publisher of this content are not responsible for any financial losses incurred as a result of relying on the information provided herein.