Garuda-DeFi is a decentralized finance (DeFi) platform built on the Terra Classic blockchain. It offers various DeFi services, including staking, lending, and borrowing. By staking your CW20 tokens on Garuda-DeFi, you can earn passive income in the form of rewards.

Why Stake CW20 Tokens?

Staking is a process where you lock up your cryptocurrency to support the network's security and earn rewards. By staking your CW20 tokens on Garuda-DeFi, you contribute to the network's stability and receive a portion of the transaction fees as rewards.

Here are some benefits of staking CW20 tokens on Garuda-DeFi:

- Passive Income: Earn rewards in the form of additional tokens.

- Support the Network: Contribute to the security and growth of the Terra Classic ecosystem.

- Community Engagement: Participate in the DeFi community and stay updated on the latest developments.

By understanding the basics of staking and the benefits it offers, you can make informed decisions about how to maximize your LUNC holdings.

Getting Started with Garuda-DeFi

Connecting Your Wallet

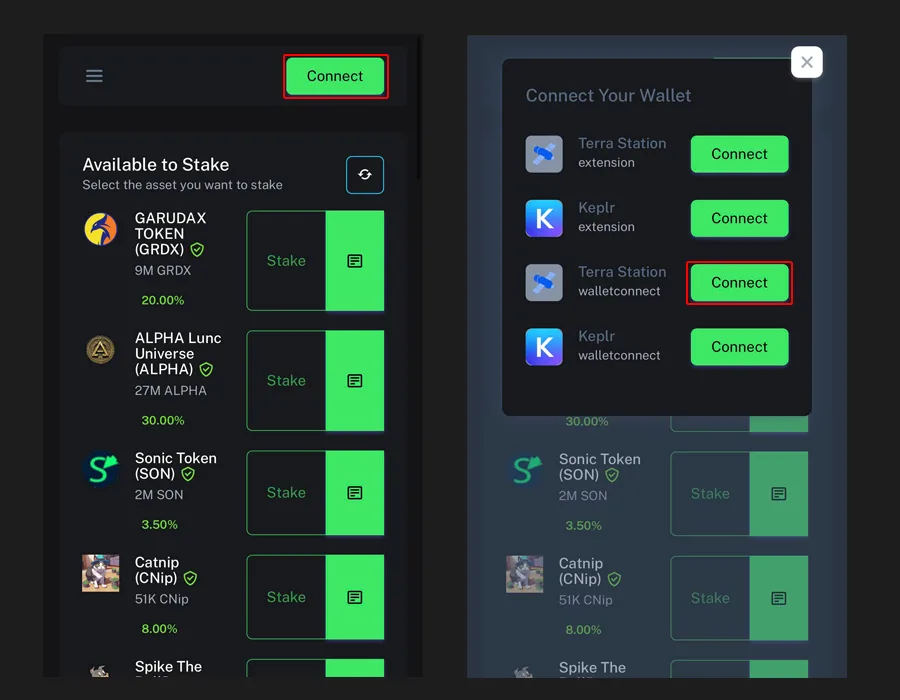

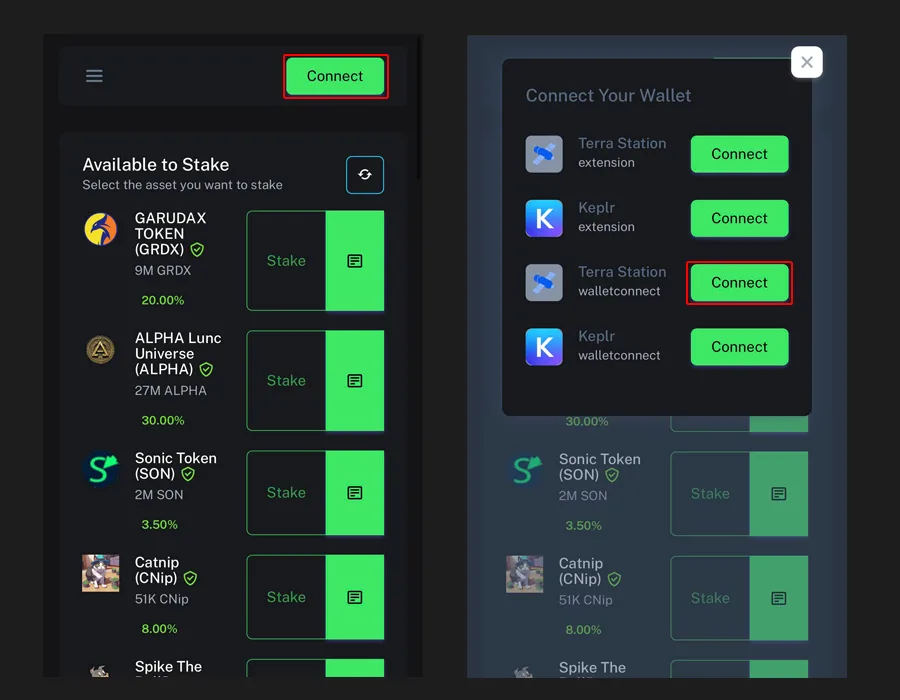

To begin your staking journey on Garuda-DeFi, you'll need to connect your wallet. In this guide, we'll use Station as an example.

- Install Station: Download and install the Station app on your device (desktop or mobile). You can follow our wallet guide here.

- Create or Import a Wallet: Create a new wallet or import an existing one using your seed phrase.

- Switch to Terra Classic Network: Switch to Terra Classic network to your wallet in setting menu, then following the on-screen instructions.

- Connect to Garuda-DeFi:

- Visit the Garuda-DeFi website: https://staking.garuda-defi.org/

- Click the Connect button to connect your wallet.

- Select Station and follow the prompts to connect your wallet.

Selecting Your Desired CW20 Token

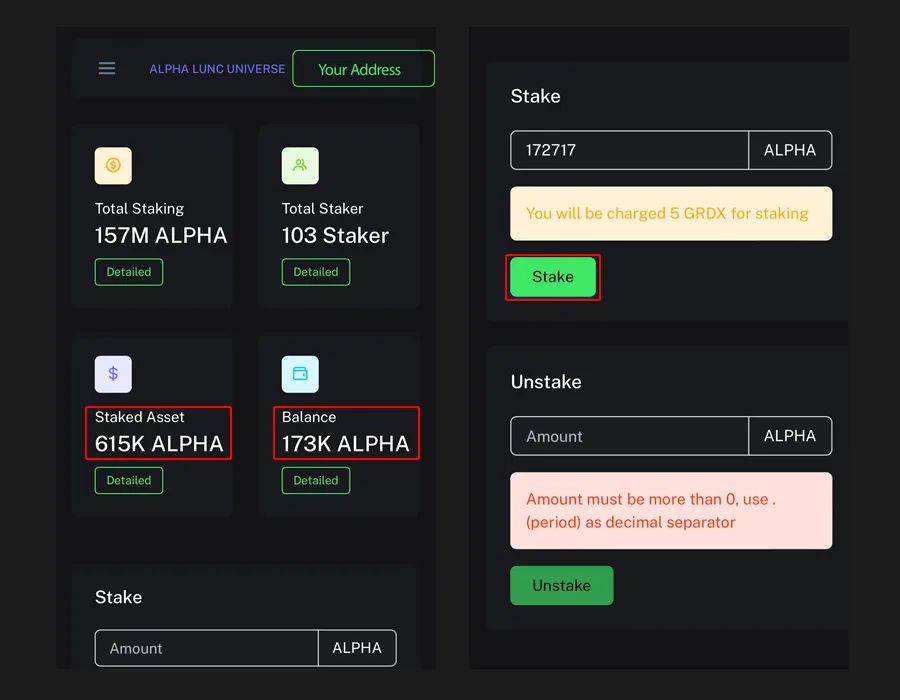

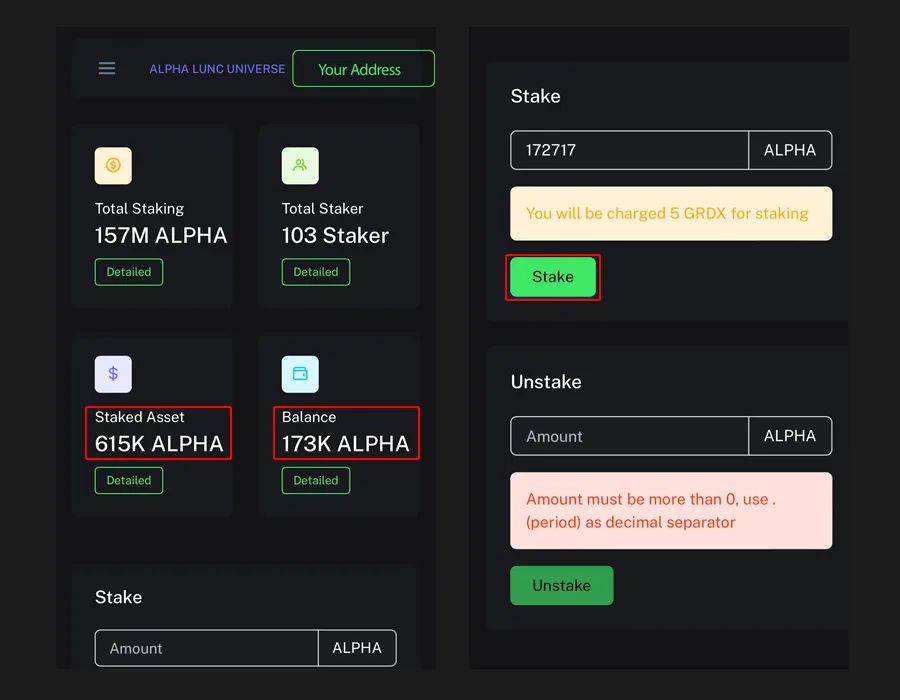

Once your wallet is connected, you'll be able to view the available CW20 tokens on the Garuda-DeFi platform. For this guide, we'll use $ALPHA as an example.

- Find $ALPHA: Search for $ALPHA in the token list or use the search bar to find it.

- Check Token Details: Review the token's details, including its contract address, balance, and staking APR.

- Select the Token: Click on the $ALPHA token to select it for staking.

Staking Your CW20 Tokens

Choosing the Amount to Stake

Once you've selected the CW20 token you want to stake (in this case, $ALPHA), you'll need to decide how much you want to stake. Consider the following factors when making your decision:

- Reward Potential: The more you stake, the higher your potential rewards.

- Liquidity Needs: Ensure you have enough liquidity for other transactions or potential market opportunities.

- Risk Tolerance: Assess your risk tolerance and adjust your staking amount accordingly.

In this guide, we stake them ALL-IN in integer number.

Initiating the Staking Process

- Input the Amount: Enter the desired amount of $ALPHA you want to stake into the designated field.

- Review and Confirm: Double-check the amount and ensure you have enough LUNC to cover the transaction fees.

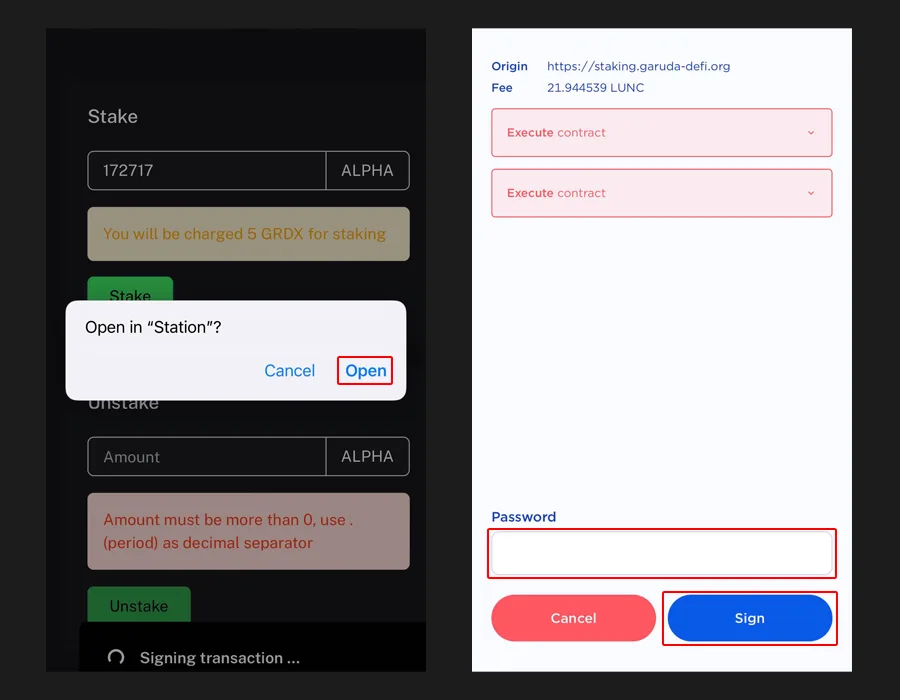

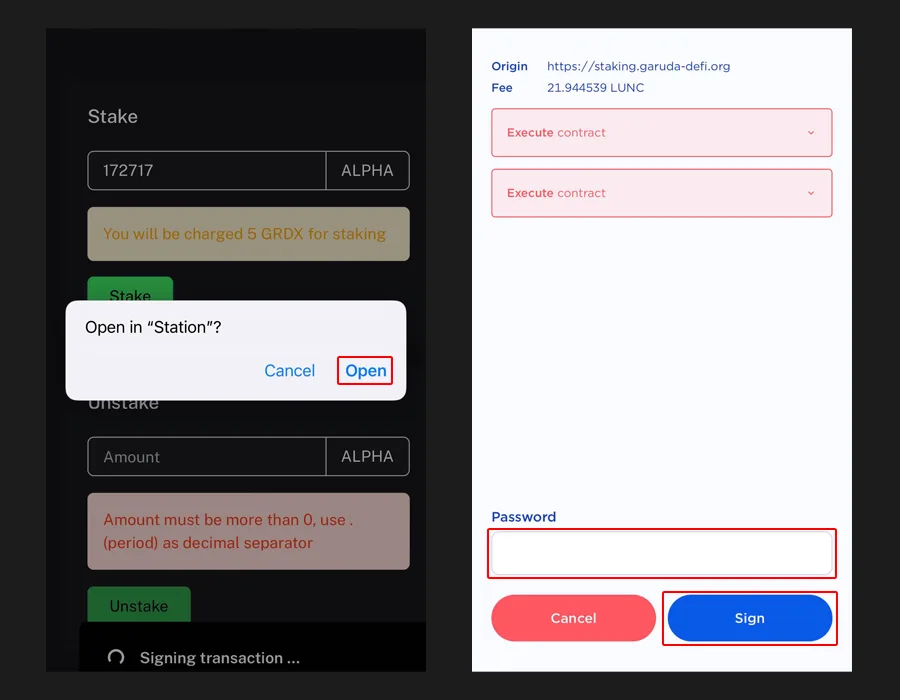

- Sign the Transaction: Your Station wallet will prompt you to sign the transaction. Review the details, input password, and confirm to proceed.

Understanding Staking Fees

To initiate the staking process, you'll need to pay a small transaction fee. This fee typically covers the network's processing costs. For staking CW20 tokens on Garuda-DeFi, the fee is currently 5 GRDX. You can learn more at our How to buy CW20 tokens guide.

Please note that transaction fees can fluctuate based on network congestion and other factors.

Tracking Your Staked Tokens

Checking Your Staked Assets

To monitor your staked CW20 tokens on Garuda-DeFi:

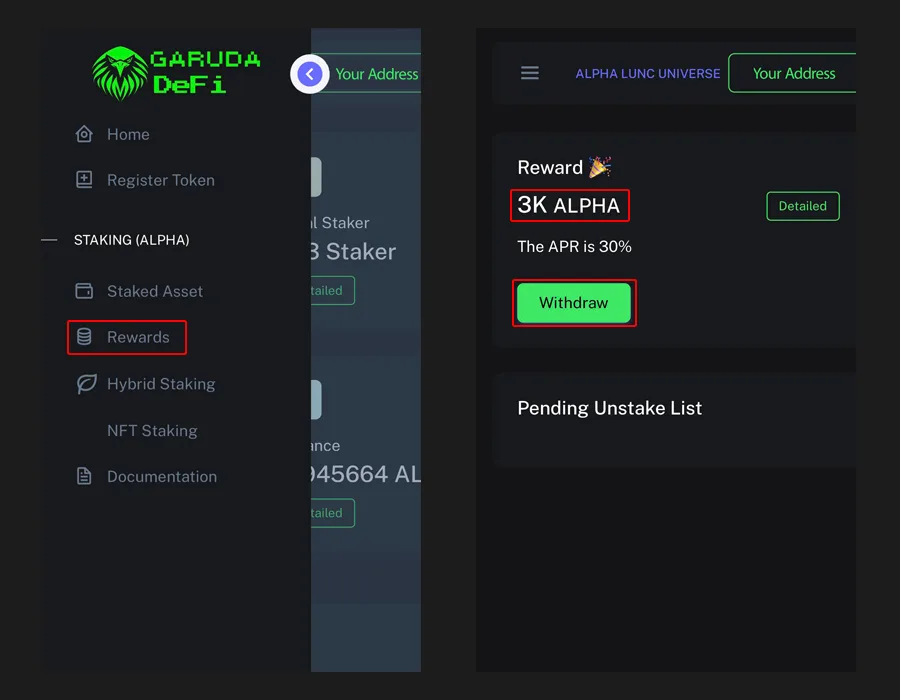

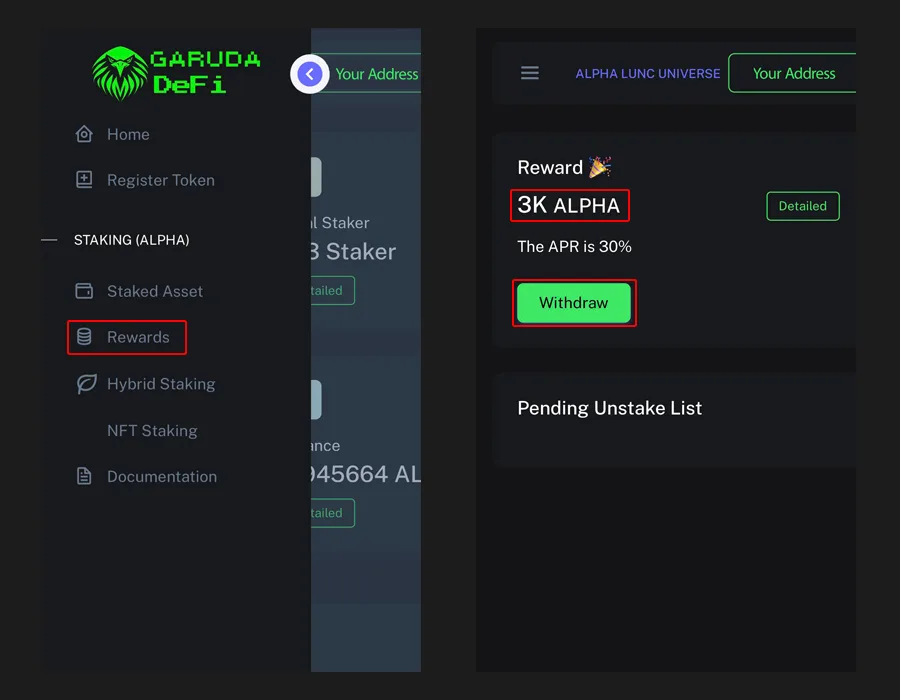

- Navigate to the Staked Assets Page: Click on the hamburger menu (three horizontal lines) in the top right corner of the screen.

- Select "My Staked Assets": From the side menu, choose the My Staked Assets option.

- Review Your Staked Tokens: This page will display a list of all your staked CW20 tokens, including the amount staked, the current APR, and the estimated rewards.

Monitoring Staking Rewards

To check your accumulated staking rewards:

- Navigate to the Rewards Page: Click on the Rewards in the side menu.

- View Rewards: You'll see the total amount of rewards you've earned from staking.

- View Detailed Rewards: Click on the Details button to see a breakdown of your rewards for each staked asset.

- Withdraw Rewards: To claim your rewards, click the Withdraw button. Please note that there may be a small transaction fee associated with withdrawing rewards.

By regularly monitoring your staked assets and rewards, you can optimize your staking strategy and maximize your returns.

Unstaking Your CW20 Tokens

Initiating the Unstaking Process

When you're ready to withdraw your staked CW20 tokens, follow these steps:

- Navigate to Your Staked Asset: Go to the My Staked Assets page.

- Select the Token to Unstake: Click on the specific CW20 token you want to unstake.

- Input the Amount: Enter the amount of tokens you wish to unstake.

- Confirm the Unstaking: Review the transaction details and confirm the unstaking process.

Understanding the Unstaking Period

Once you initiate the unstaking process, there's usually an unstaking period. This is the time it takes for your staked tokens to become available for withdrawal. The duration of the unstaking period can vary depending on the specific token and the platform's configuration.

Claiming Your Unstaked Tokens

After the unstaking period has ended, you can claim your tokens:

- Navigate to the "My Staked Assets" Page: Go to the My Staked Assets page.

- Select the Unstaked Token: Click on the token you want to claim.

- Claim Your Tokens: Click the Claim button to transfer the unstaked tokens to your wallet.

Remember to factor in any associated transaction fees when unstaking and claiming your tokens.

Tips for Managing Multiple Wallets

When working with multiple wallet addresses, you might encounter issues with your web browser remembering previous wallet address. This can be particularly problematic when switching between different wallets on the same device.

Here's a simple solution:

- Use Incognito or Private Browsing Mode: This mode prevents your browser from storing browsing history, cookies, and other data. By opening a new incognito or private window, you can ensure that your browser isn't automatically filling in your previous wallet address.

- Clear Browser Cache and Cookies: Periodically clearing your browser's cache and cookies can help prevent conflicts and ensure smooth wallet connections.

By following these tips, you can easily manage multiple wallets and avoid any potential issues.

Conclusion

Staking your CW20 tokens on Garuda-DeFi is a straightforward process that can yield significant rewards. By following the steps outlined in this guide, you can actively participate in the Terra Classic ecosystem and earn passive income.

Key Takeaways:

- Connect Your Wallet: Use a compatible wallet like Station or Keplr to interact with Garuda-DeFi.

- Select Your Token: Choose the CW20 token you want to stake, considering its potential rewards and risk factors.

- Initiate Staking: Input the desired amount, review the transaction details, and confirm the staking process.

- Monitor Your Staked Assets: Keep track of your staked tokens and earned rewards.

- Unstake Your Tokens: When you're ready to withdraw your tokens, initiate the unstaking process and wait for the cooldown period.

Remember to stay informed about the latest developments in the Terra Classic ecosystem, as staking rewards and platform features may change over time.

Disclaimer: This is not financial advice

The content provided on this platform is intended for informational and educational purposes only, and should not be construed as financial advice, recommendation, or solicitation to buy, sell, or hold any cryptocurrency or investment. Investing in cryptocurrencies and other digital assets carries significant risks, including the risk of loss of principal. It is essential to conduct thorough research and due diligence before making any investment decisions.

Always consult with a qualified financial advisor to assess your financial situation and risk tolerance before making investment choices. The author and publisher of this content are not responsible for any financial losses incurred as a result of relying on the information provided herein.