Staking your LUNC tokens is a great way to earn passive income and support the Terra Classic network. However, choosing the right validator is crucial to maximizing your returns. In this guide, we'll explore the key factors to consider when selecting validators with the highest APR (Annual Percentage Rate).

By understanding the importance of APR, commission rates, and validator reliability, you can make informed decisions and optimize your LUNC staking rewards. Let's dive in!

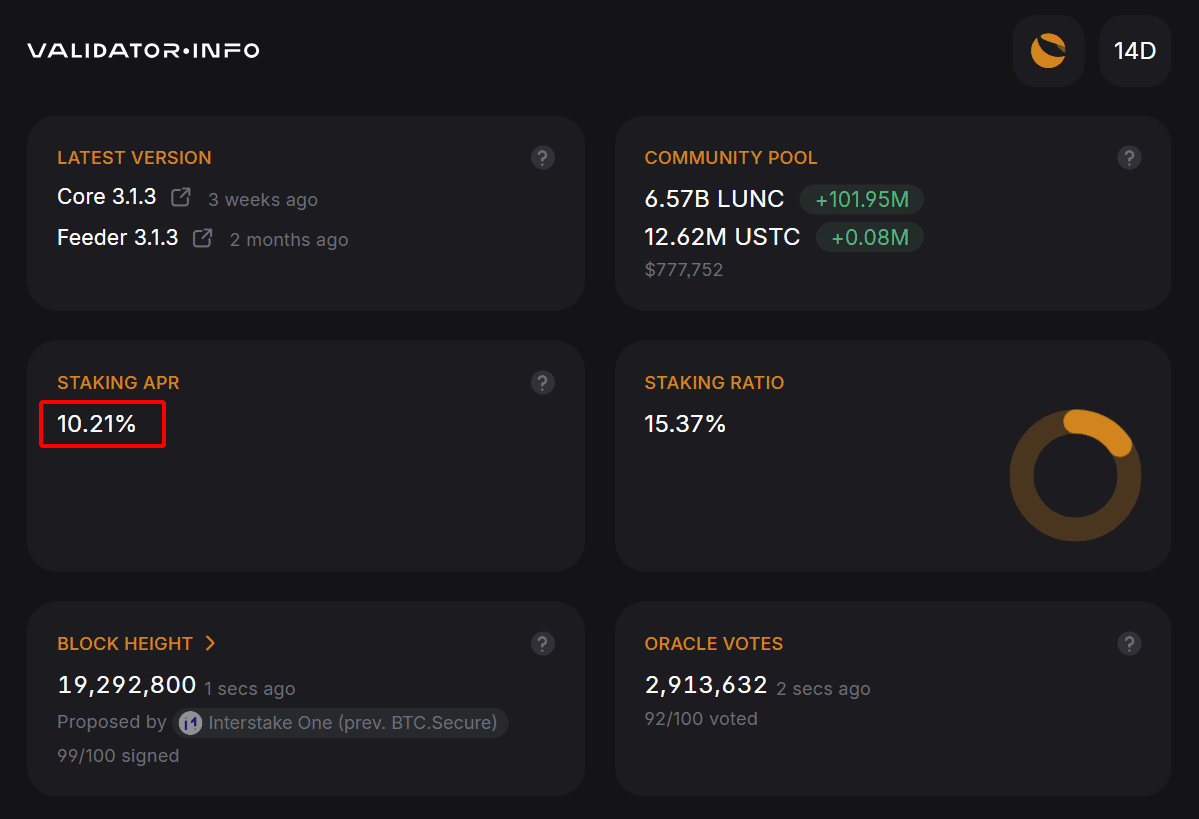

Right now, as of 10th August, 2024, Luna Classic boasts an impressive Annual Percentage Rate (APR) of 10.23%. This translates to the annual return you can potentially earn by staking your Luna Classic. New to crypto rewards? Don't worry, it's simple! Staking involves locking up your Luna Classic for a set period to earn passive income.

Head over to Validator.Info! This handy platform lets you track the current APR in real-time.

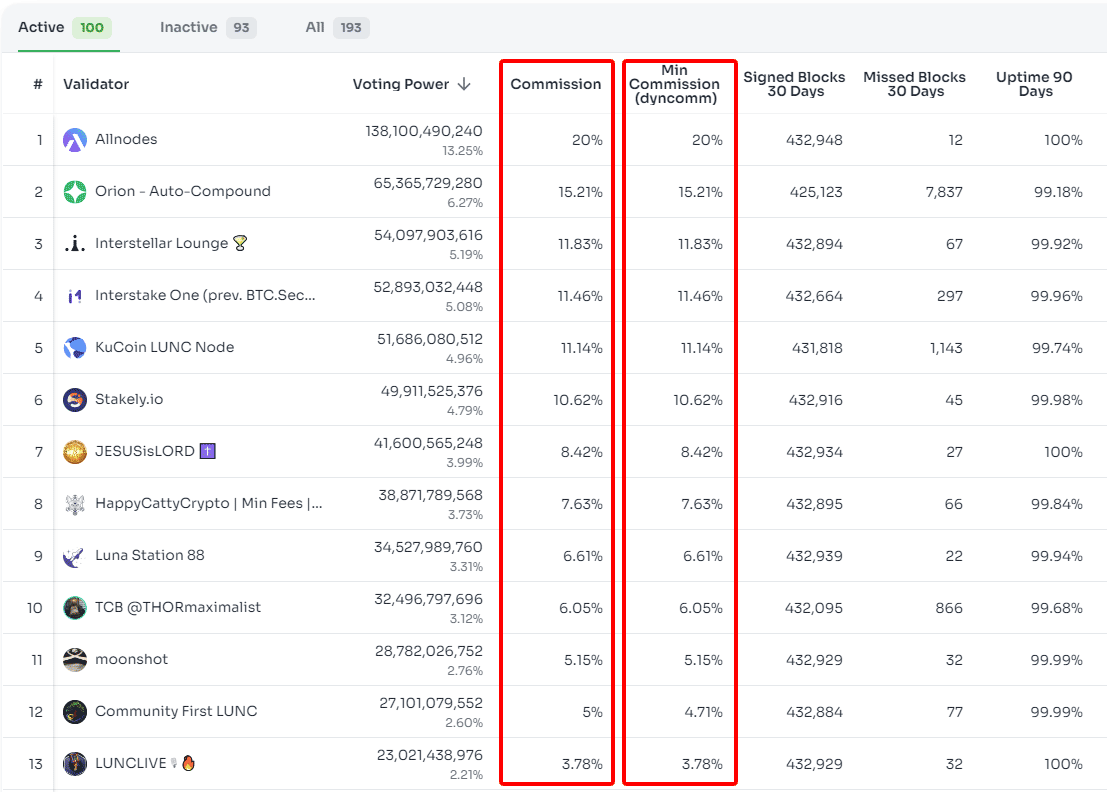

When you choose a validator to stake your Luna Classic with, they take a commission on the rewards. Think of it like a small service fee. Here's the key: higher commission translates to lower rewards for you. So, most investors aim for validators with the lowest commission for maximum returns.

You might have come across the term DynComm. It's an algorithm that automatically adjusts the minimum commission for the top validators based on their voting power. Think of it like a way to level the playing field.

This, however, serves a purpose! DynComm helps distribute voting power more evenly, leading to a more decentralized validator network for Luna Classic.

Many Luna Classic investors are on the hunt for validators charging the coveted 2.5% commission rate. But how do you spot these diamonds in the rough? Read on!

To find out what commission fee a validator is charging, you'll need to use StakeBin. This platform provides a clear breakdown of each validator, including their commission rate. Remember, there's a minimum commission set by the system, but validators can charge more. So, while you might spot some offering the coveted 2.5% rate, others may charge a bit more.

When selecting a validator for your Luna Classic staking, two primary strategies emerge: those seeking a hands-off approach often prioritize top-tier validators for stability, while others prioritize maximizing returns by targeting validators with the lowest commission rates. Ultimately, the optimal choice depends on individual risk tolerance and desired level of involvement.

You better delegate to validator in top 20 and forget. You get lower rewards for lower maintenance. This is my preferred list.

| Recommended Validator | Commission Fee |

|---|---|

| Allnodes | 20% |

| LUNC LIVE | 3.78% |

You want to choose validators with lowest commission possible at 2.5%. This is my preferred list:

| Recommended Validator | Commission Fee |

|---|---|

| Classic Nodes | 2.5% |

| Battle-Force LUNC | 2.5% |

| LVS Node | 2.5% |

| Lighthouse Node | 2.5% |

| FireFi Capital | 2.5% |

| LunaClassic Turkish Validator | 2.5% |

However, if you chose this route, it's crucial to monitor your validator's voting behaviour. Are they aligning with your vision for the future of Luna Classic? Secondly, keep staying informed and actively managing your staking, you can maximize your returns and contribute to the health of the Luna Classic ecosystem.

A common question among Luna Classic stakers is whether to spread your tokens across multiple validators or stick with one you trust. There's no right or wrong answer here – it boils down to personal preference and risk tolerance. Some investors like to diversify their bets, while others prefer a more hands-off approach.

So, is 10.23% a good APR for staking Luna Classic? Let's put it into perspective. Binance currently offers a flexible earning option for Luna Classic, but it comes with a catch: the APR is a mere 0.34%. Compare that to the 10.23% available through staking directly on the Luna Classic chain, and it's clear which option offers the more lucrative rewards.

Choose what you like, or split your portfolio and do both.

Remember: While a higher APR is enticing, it's essential to balance rewards with the potential risks associated with your chosen validator. We'll delve deeper into choosing the right validator in our next article.

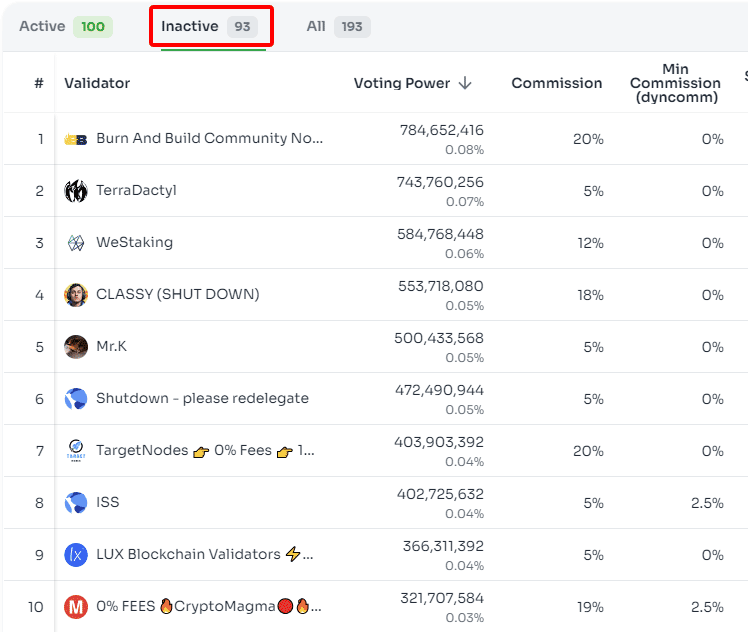

If your validator shows as "jailed," it means they're currently not processing transactions and you're missing out on those juicy rewards.

Head over to StakeBin! This handy platform lets you easily check validator status. Simply navigate to the "Inactive" tab – if your validator's there, it's time to redelegate.

Don't panic! Here's a quick guide to get you back on track.

This can happen for various reasons, but the key takeaway is simple: redelegate your Luna Classic to an active validator to start earning again. After all, staking deserves rewards!

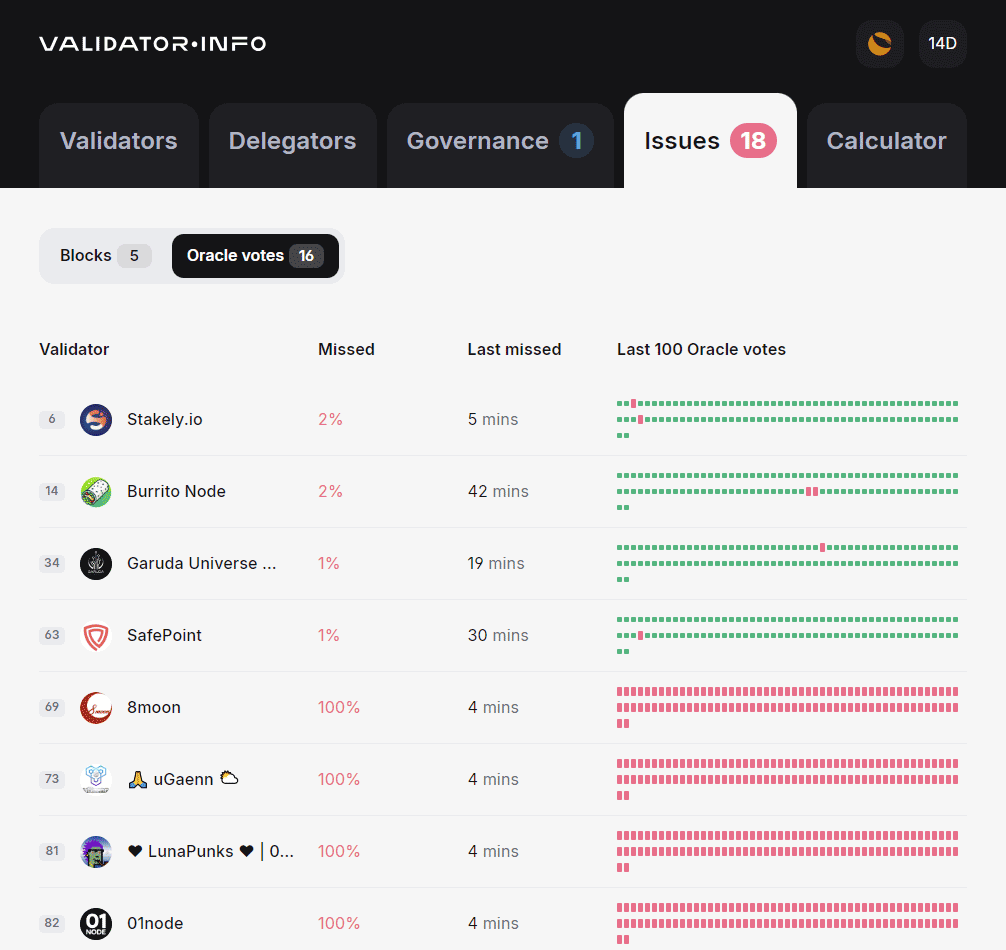

Technical glitches are a reality, and how validators handle them matters. To gauge your validator's overall health, visit Validator.Info and scroll down to "Validators with Issues." A sea of red flags should raise an eyebrow. While most validators address issues promptly, a pattern of problems suggests it might be time to find a new home for your Luna Classic.

Remember: By staying vigilant and making informed choices, you can ensure your Luna Classic staking journey is smooth sailing and maximizes your returns. Stay tuned for our next guides, where we'll explore more into Terra Classic blockchain!

Choosing the right validator for staking LUNC is crucial to maximizing your returns. By considering factors like APR, commission rates, and validator reliability, you can make an informed decision and optimize your earnings.

By following these guidelines, you can effectively choose validators that align with your goals and maximize your LUNC staking rewards.

The content provided on this platform is intended for informational and educational purposes only, and should not be construed as financial advice, recommendation, or solicitation to buy, sell, or hold any cryptocurrency or investment. Investing in cryptocurrencies and other digital assets carries significant risks, including the risk of loss of principal. It is essential to conduct thorough research and due diligence before making any investment decisions.

Always consult with a qualified financial advisor to assess your financial situation and risk tolerance before making investment choices. The author and publisher of this content are not responsible for any financial losses incurred as a result of relying on the information provided herein.