Reverse Charge: Solution to Terra Classic's Tax2Gas Dilemma

By: LuncScan Team | 778 views | 24 shares

By: LuncScan Team | 778 views | 24 shares

Terra Classic's existing tax system has posed significant challenges for developers, particularly those new to the ecosystem. The requirement for senders to pay an additional tax on top of transaction fees has created a development barrier, hindering the growth of dApps on the network.

To address these challenges, the Tax2gas mechanism was proposed. However, despite initial optimism, the implementation of tax2gas by Genuine Labs faced several setbacks. These setbacks included:

A new approach, dubbed Reverse Charge, has emerged as a promising solution to the tax development barrier. This innovative method shifts the responsibility for paying taxes from the sender to the recipient. This means that the tax will be automatically deducted from the funds before they reach the recipient's wallet.

“The new approach moves tax handling entirely to the blockchain. Instead of requiring the sender to cover the tax as an extra fee, the tax will be automatically deducted from the amount sent, effectively happening before funds reach the recipient's wallet. The sender no longer has to worry about paying extra, and developers won't need to implement additional features to deal with tax calculations.”

The Reverse Charge approach effectively addresses the concerns raised with the tax2gas implementation. It offers a more efficient and streamlined solution that avoids issues such as inaccurate fee display, compatibility problems with existing wallets, and additional work for developers.

The Reverse Charge solution does not affect the overall burn mechanism or the existing whitelisting agreement with Binance. In fact, it introduces a new "tax zones" feature that allows for more granular governance control over whitelisting.

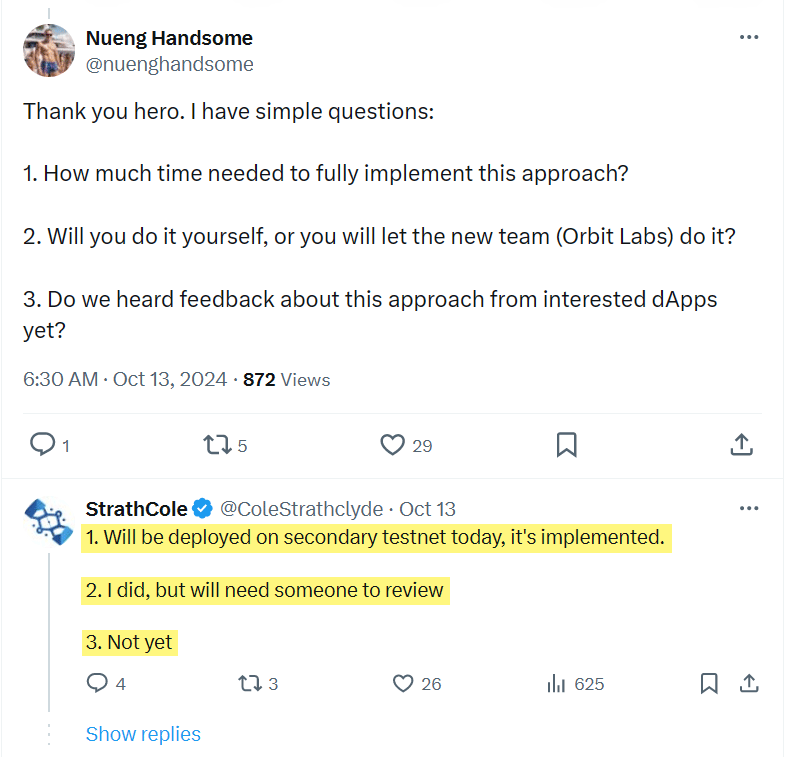

Luckily, the implemend is simple enough, and StrathCole was able to do it in a single day on his own.

StrathCole's response for Reverse Charge. Source: X.com

The Reverse Charge code is already developed and ready for testing on the hellnet-1 testnet. Once testing is complete and the community approves the approach through governance, it will be deployed on the mainnet.

The Reverse Charge approach has the potential to significantly improve the development experience on Terra Classic. By simplifying tax handling and eliminating double taxation, it can attract more developers and foster the growth of the ecosystem. With proper testing and community support, this solution could be a game-changer for Terra Classic.

The content provided on this platform is intended for informational and educational purposes only, and should not be construed as financial advice, recommendation, or solicitation to buy, sell, or hold any cryptocurrency or investment. Investing in cryptocurrencies and other digital assets carries significant risks, including the risk of loss of principal. It is essential to conduct thorough research and due diligence before making any investment decisions.

Always consult with a qualified financial advisor to assess your financial situation and risk tolerance before making investment choices. The author and publisher of this content are not responsible for any financial losses incurred as a result of relying on the information provided herein.